Selecting the Best Software for Your Travel Agency

ABSTRACT: Matching software capabilities against your agency’s business requirements can help identify the best IT solution. There is no “One Size Fits All” solution because there are no two agencies that compete the same way. No two agencies have the same policies, procedures, or management practices. Each agency is different and each requires a unique solution.

Every Travel Agency is unique. No two are the same. Even when located next to each other, they offer different services, target different customers, staff differently, and are managed differently. In short, they are different businesses.

There is no software that meets all the needs for all agencies. Either the agency must change the way it does business or they must modify the software – an expensive alternative. However, by matching software capabilities to business needs, an agency can find the best available solution for their own unique business.

Historically the most common way to select software was to compare each alternative with all the others on a feature-by-feature basis. Common thought suggested that the software with the most features and/or the best features was the best software for any business. Many providers marketed their products (and still do) believing that most clients will choose the most feature-rich offering. This is an illogical conclusion. Having the most features is no guarantee that the software is the best solution for any Travel Agent.

One way to determine the best “fit” to your business is to define your needs then rate how well the software being considered meets those needs. This simple methodology ensures that the best solution for your business can be identified when properly evaluated.

Attached to this blog is a downloadable Microsoft Office Excel workbook you can use without any programming or Excel experience. ‘Sliders” are used for all user inputs.

Over the last two decades, Nucore clients have identified the most important features for their travel agencies. You can rate these features according to how important each is to your agency. Then, by rating how well each feature is performed by the software being considered, you can identify the software that best fits your agency’s unique requirements.

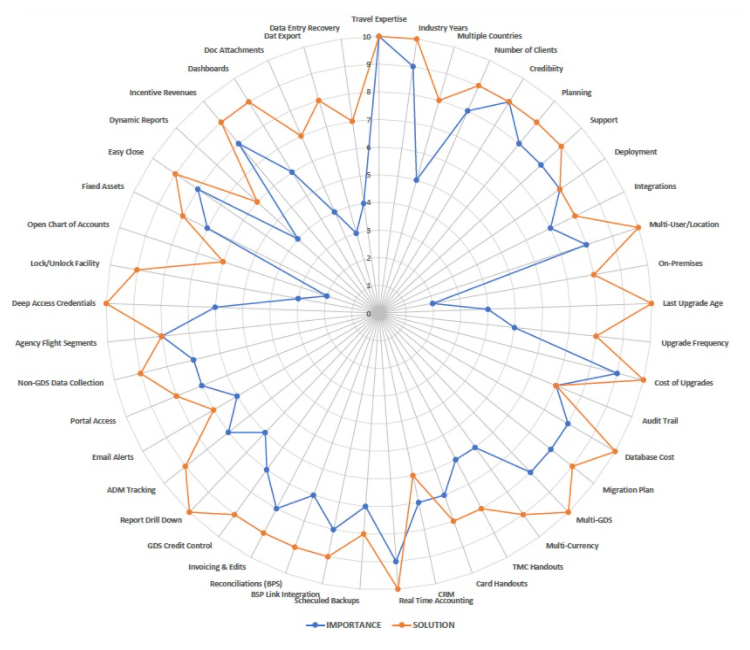

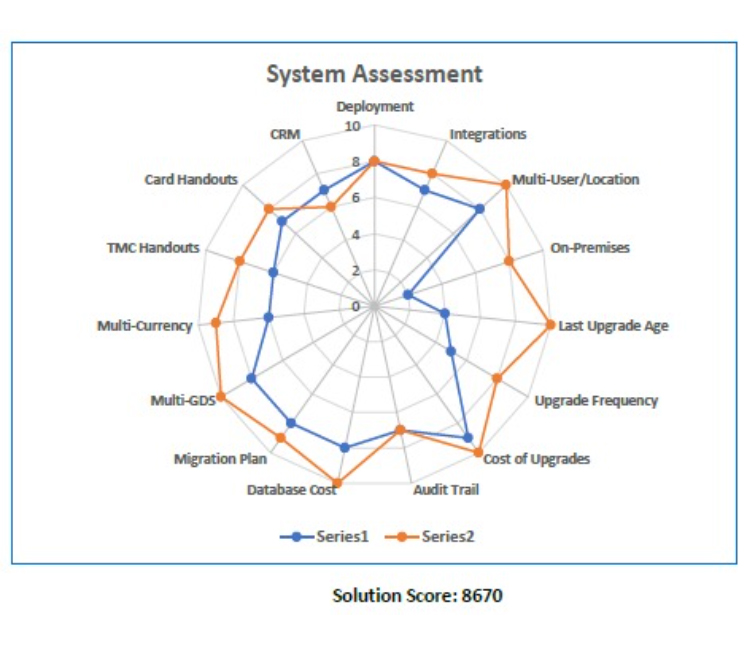

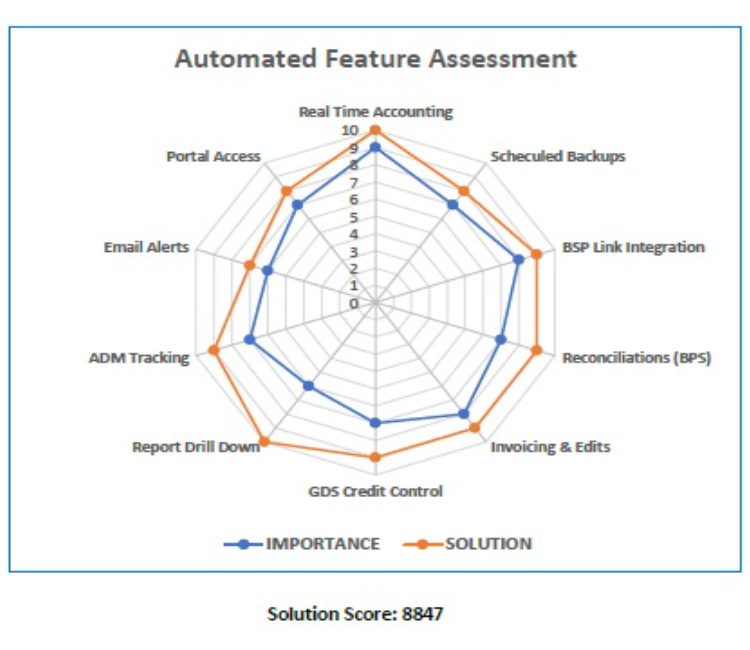

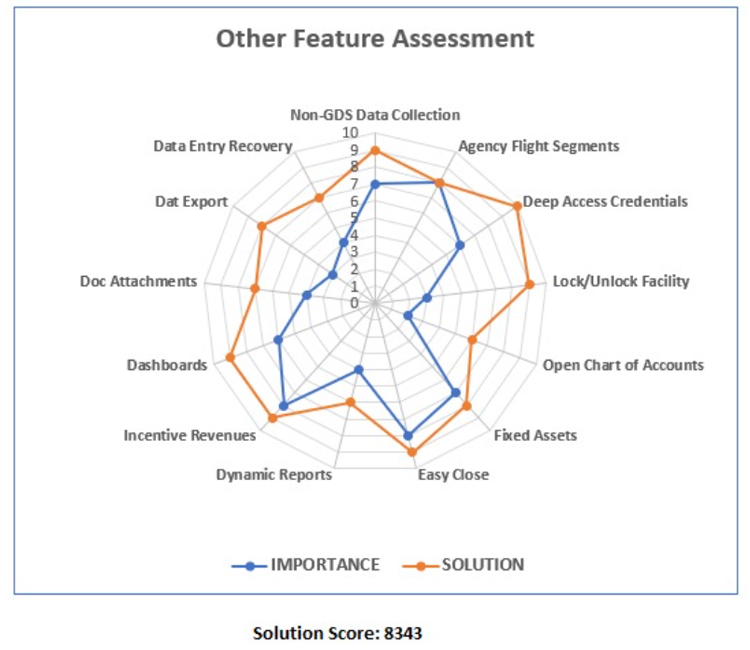

An assessment Score is calculated for comparing one software alternative to another. Assessment results are presented in a series of easy-to-read data visualizations as illustrated in Figure 1. The assessment tool calculates five different scores – An Overall Solution Score and a score for each of four sectors – Corporate, System, Automated Features, and all “Other” features.

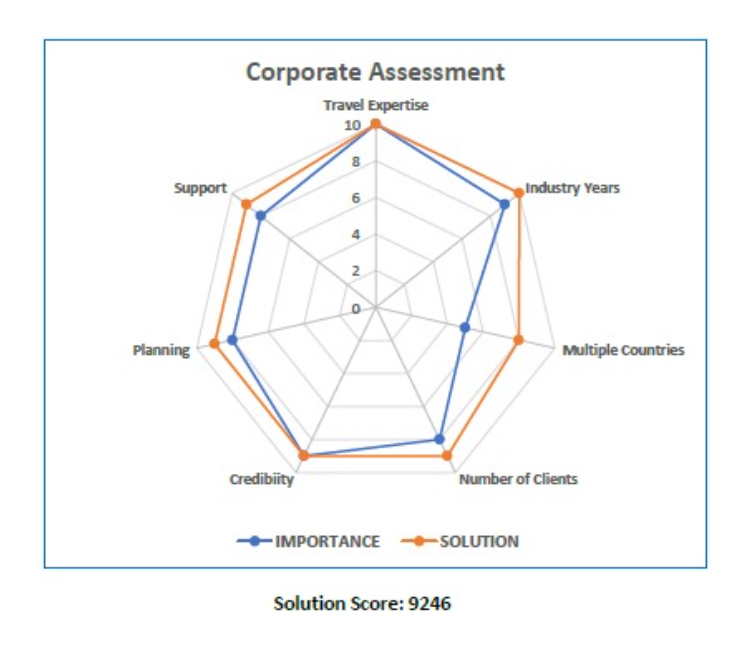

The Assessment plots the “Importance” of each radial item and the “Solution” rating (assessment) of that same radial line item. If the Solution (blue line) is on or outside the Importance (red line), it meets or exceeds your agency’s standard requirement. If the Solution is inside the Importance, it may fall short of your line item requirement.

Corporate Assessment

Clients continuously emphasize the importance of the technology provider – the most important consideration being the industry expertise demonstrated by the number of years in business and the geographical expanse of clients. Both are indicators of the company’s ability to satisfy customers by solving client-specific problems and supporting international commerce. Customer testimonials, live demonstrations, verified case studies, and client feedback are indicators of provider credibility.

Customer support is well known by every client’s firsthand experience and should be a major factor in any decision. Incident tracking, multiple Service Level Agreements, and timelines to problem resolutions are all required for clients to provide a positive feedback. Verify support with existing clients.

If a legacy system replacement is being considered, then the provider’s ability to plan and implement a smooth transition with minimal business interruption must be determined. Close collaboration with the client, project management, data migration competency, and on-site support can minimize business impacts. A good technology partner should provide direct contact to clients who have gone through a similar transition to the one being proposed.

Price is always a consideration but should be addressed after the value of the deliverable is clearly understood. Purchase price is only part of the equation. It is the ongoing Cost-of-Ownership (CoO) and the realizable Return On the Investment (ROI) that should define an acceptable price (purchased, leased, financed, or otherwise). The degree of automation, as just one example, can reduce the operating cost per transaction significantly impacting profits as well as both CoO and ROI. The old adage that “you get what you paid for” has never been more true. Existing clients can verify the operational improvements they have experienced.

The attached MS Excel assessment tool rates a provider’s corporate integrity by matching the technology provider’s past performance to your agency’s requirements. By rating the importance of each of the above characteristics to your agency, then rating the providers against those same characteristics, the tool will provide a Corporate Assessment “Solution Score” that can be used to compare different providers. The higher the Solution Score for the Corporate Assessment the better that provider will meet your agency’s needs (Figure 2).

NOTE: Once the importance of each characteristic has been determined, it should not be changed from assessment to assessment or the relative Solution Scores may be invalidated. The importance rating is the “standard” for your agency’s requirements and remains constant across all assessments. Once the importance ratings have been set, the remaining assessments become easier and less time to complete..

System Assessment

System capabilities can drive immediate decisions if a single capability is absent. For example, if your agency requires your staff to work remotely, and the system is incapable of supporting that feature, then the system will not be a potential solution.

For all other system features, the decision is not a simple “go or no go”. System performance for your agency will vary from provider to provider and should be valued by the importance to your existing, contemplated, or end-goal requirements.

The COVID pandemic raised the value of being able to support a fully functional remote workforce. The deployment options can range from a simple desktop or terminal capability to an online web-based or cloud implementation. If security and backup are major concerns, then an on-premises implementation might be the right deployment, or a parallel deployment capability. Which deployment will be important to your agency may also depend on if you are a single location agency, have multiple locations, or serve third party corporate clients.

The ability to integrate front, mid, and back office capabilities can reduce interdepartmental dependencies and lower staff skill requirements. This system characteristic is also the basic requirement of any solution to be the platform for a customized ERP solution where the best third-party software for your agency, such as a bookings system, can be integrated into your software solution.

Add-on modules, such as Customer Relationship Management (CRM) and Business Intelligence (BI) provide a level of customization that has already been implemented for other clients and can benefit your agency in the future as low-cost options to better manage your business. Both are mid-office and front office modules that demonstrate the system’s ability to integrate and customize your solution.

The ability to support accounting and reporting for multiple users, multiple locations, and multiple departments, may be a mandatory requirement particularly for franchise agencies and Travel Management Companies. Without this ability, manual interventions and off-system support (e.g. Excel post-report data manipulations) will escalate staffing, skill levels, and operating costs.

System access privileges should be able to be defined by each user’s role in the organization and unrestricted in the privileges assigned to any user. A related lock/unlock facility by user should also apply by ledger, document, or pre-defined time period. These global functions are strong indications of an open architectural design and should weigh heavily in the applicability and, therefore, the importance of any software solution.

Database licenses can become more expensive with growth as well as usage. The database should have a long history of acceptable performance and vendor support. Ideally, the license fees can be avoided altogether is the solution uses well-supported vendor or open-sourced software (e.g. MySQL or PostgreSQL). Later migrations will also avoid license fees. Whatever the database selected, the migration from your current database to the new database will require support from your new technology partner. Planning a migration, implementing the plan, and training staff should be a highly collaborative exercise if it is to minimize business disruptions.

Whether or not your agency currently requires multiple GDS compatibility and multiple currency support, both capabilities should be ranked as a high importance for future growth. These system capabilities are also strong indicators of the system’s ability to process different agency requirements. If your agency needs to add or change its GDS or reporting currency, having the capability prior to demand will save time and the cost to upgrade in the future.

If your agency interfaces with Low Cost Carriers (LCC) not on a GDS (e.g. Air Arabia, Air India Express, Cebu Pacific, ant others) then your system should be able to pull the required data from web-scrapping or through an API connectivity.

If your agency is a TMC, an important system feature will be the ability to provide data handouts for AMEX, GBT, CWT and FCM as well as corporate card handouts for Airplus, AMEX, BTA, UATP, MasterCard, and others. Without these capabilities manual labor costs will track growth instead of decline with scaling.

The system should provide an detailed audit trail and version control of your agency’s installation. This is extremely helpful to avoid any downtime should it become necessary to reverse a recent upgrade or corrupted system by simply reinstalling a previous release level.

How often a system is upgraded and at what cost will impact the cost of ownership, the return on the investment, and the long-term viability of the system itself. Todays state of the art technologies allow updates, even upgrades, to be frequent and seamless. A system that does not need to upgrade from one generation to the next but is updated over time will cost less and more importantly, serve your agency for a much longer period of time without becoming obsolete legacy software.

Automation is going to continue as digital transformation continues to scale up at an ever-increasing rate across the industry. The drivers of automation are the cost reduction benefits derived from eliminating labor and human error.

Without an emphasis on automation, an agency’s competitiveness, even with an outstanding level of customer service will erode over time. If the financial system serving as the ERP platform for all integrated systems and add-on applications has the state-of-the-art architecture and deployment features listed in the attached assessment tool, then your agency’s competitiveness should be able to be enhanced for years to come through additional integrations and add-ons that use these advanced system and automated features.

Automatic Functions Assessment

One of the most important automated features embedded deep within the architecture would be real time accounting which enables dynamic reporting, on-demand client and provider account balances, and virtually instant management reports and insights. Real time accounting across the entire financial system eliminates countless hours of manual queries, rework, and, most importantly, can avoid those too-late-to-change bad decisions made from outdated information.

Real time GDS credit control, system and email alerts, automated invoicing (and editing), accurate report drill downs (to the originating ticket/PNR documents), and book closing assistance are only a few features made possibly by real time accounting. These features are less likely to be present in a non-travel industry ERP system. A system without these features will not realize the cost reduction benefits of automation.

Recently, IATA changed its Agency Debit Memo and return authorization policies and procedures to level organizational cash requirements. With an automated, real time GDS BSP link, ADMS and returns can be tracked and resolved quickly, before accumulating into a cash flow problem for your company. If your agency is the chokepoint during market transitions, it is your cashflow that will absorb the impact.

Real time accounting also simplifies automatic backup and recovery in that far fewer transactions and files would be open at any point in time. This greatly simplifies the complexity and time required for recovery following an unexpected shutdown such as a power disruption or security breach. Automatic backups also ensure the process will not be attempted incorrectly or bypassed due to human error.

Perhaps the most noticeable day-to-day benefit of an automated function would be reconciliation, an otherwise intensive and potentially complex function to execute manually. Not only does automatic reconciliation simplify the process, but it can now be done by staff who are not accountants. Of particular importance would be automatic BSP linking and GDS reconciliations. Banks, hotels, car rentals and other providers would not be far behind.

If your agency maintains, or plans to initiate, an online portal for clients and sourcing providers, then real time accounting can provide the most accurate, up to the minute, financial information required for self-serving applications. Customers should be able to pull invoices, credit notes, ticket copies and account statements directly from their portal access.

Automation is going to continue as digital transformation continues to scale up at an ever-increasing rate across the industry. The drivers of automation are the cost reduction benefits derived from eliminating labor and human error.

Without an emphasis on automation, an agency’s competitiveness, even with an outstanding level of customer service will erode over time. If the financial system serving as the ERP platform for all integrated systems and add-on applications has the state-of-the-art architecture and deployment features listed in the attached assessment tool, then your agency’s competitiveness should be able to be enhanced for years to come through additional integrations and add-ons that use these advanced system and automated features.

Other Features Assessment

There are too many other features than can be list in this blog. However, a representative number of features can go a long way towards providing an accurate indication of any systems’ full feature set. The following features were selected to be such a representation. Although not presented in any specific order, the following do cross a wide range of agency processes in order to reflect a reasonable assessment of any system’s full feature set.

Features should be able to be automated and added whenever needed. If journal entries are excessive, it is an indication that some part of your normal business process is not being supported by your information technology as well as it could be. The following features may be part of the root cause.

Managing revenue opportunities is a recent system capability trend. Being able to track flight segments booked by your agency by each deployed GDS system can provide the information necessary for day-to-day management of agent actions regarding bookings, itineraries, resolution of ADMs and minimizing cancellations and returns. Daily flown revenue reports would help increase agency incentive payments. Without this kind of daily revenue information, management can be blind until the end of the reporting week or even month.

Sometimes the simplest sounding feature can have a significant impact. One such hidden feature is the system’s ability to provide an unrestricted Chart of Accounts – a feature that once set up is taken for granted and rarely appreciated until needed again. The Chart of Accounts should not have any limit on account coding, the number of account levels, account grouping/regrouping, or the ability to move a ledger.

Another “simple” feature is the ability to attach a document to any report, transaction, or other document. Although simple to describe, it drives deep into a system’s capabilities to work without restriction. Attaching documents eliminates the need to track down information that otherwise can be provided “at the user’s fingertips” – at the precise location they are currently looking at.

Data entry is another large part of an agency’s daily workload. A feature that allows the automatic reversal of data entries, can reduce the hours needed to be spent by higher skilled labor to manually find and correct simple mistakes.

Some systems offer a large selection of “standard” management information reports and pre-defined management dashboards. Several versions of sales reports, customer and supplier reports, airline reports, productivity and efficiency reports, A/R and A/P reports, financial statements, and other reports can be great time savers. If generated by business intelligence, CRM, fixed asset, and other add-ons, they can become essential tools for management. Reports are then expanded to include asset purchases and sales, write-offs, and depreciations – reports for both management and reporting government and legal entities.

A feature that is easy to overlook during system comparisons is the ease of exporting data for external analysis and other manipulation done for not only your agency but your suppliers and even some of your clients. Being able to accurately export different formats on demand (e.g. CSV, Excel, PDF, XML and other common formats) can be very helpful to all your agency’s relationships.

The Other Feature Assessment and Solution Score should be representative of most system’s full-feature set. However, if a specific feature is considered to have an unusual benefit, the feature can be added to any of the four sectors in the Assessment Tool then weighted in importance and solution performance as deemed appropriate for comparison to other system assessments.

All four assessments (Corporate, System, Automated Features, and “Other Features”) are combined for an overall Solutions Score (see Figure 1 at the beginning of this blog).

The attached assessment tool is not intended to be a decision matrix but rather a guide to help the path to a final decision to be made more intelligently and in less time than would otherwise be required. The main objective is to narrow down your agency alternatives for more detailed review as fast and as accurately as is possible.